Tel: 0800 012 1117

Menu

Pension essentials

In the Fund

Retired

Resources

The Trustee provides a carefully-chosen range of funds for members of defined contribution arrangements (which includes BRASS and AVC Extra) to invest in. It regularly assesses the performance of those funds and whether they continue to meet members’ needs.

After reviewing the previous range of funds, the Trustee agreed it was necessary to make some changes to provide members with new options to help support their retirement plans.

You can log into your myFund account to review the new fund range and can change your investments if you wish.

We have introduced 4 new investment funds:

These are available alongside 3 of the previous investment funds:

There are also 3 new Lifestyle strategies. With Lifestyle strategies, your investment allocations are managed for you, with your holdings moved automatically into the most appropriate funds based on the time left until you want to take your benefits. The new strategies are:

You can invest in one or more of the Lifestyle strategies and as many (or as few) of the investment funds as you wish.

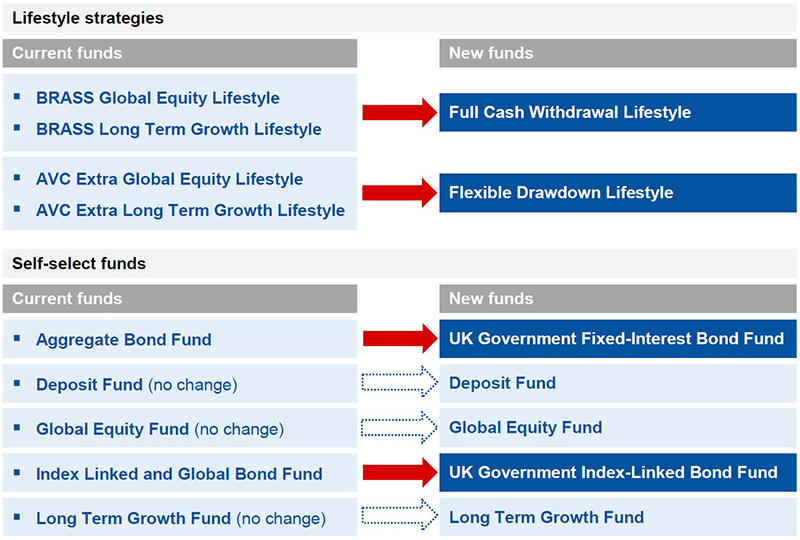

Two of the previous investment funds (the Aggregate Bond Fund and Index-Linked and Global Bond Fund) have now closed, as have the Global Equity Lifestyle strategy and Long Term Growth Lifestyle strategy.

We wrote to members of BRASS and AVC Extra in both February and April to let them know about the changes and explain how their existing investments would be moved into the new fund range. We have now completed those changes.

Members of BRASS and AVC Extra can review their fund choices when they log into their myFund account and change them if they wish. Go to the ‘My Pension’ section of your account and select the ‘My AVCs’ page.

The changes that the Trustee has made to the fund range meant that some lifestyle strategies and investment funds were closed. If you had holdings in funds that were closing, they had to be moved out of these.

If you were invested in one or more of the strategies and funds that closed, we automatically moved your holdings into the new range. This table shows how this was done:

There is a lot of information about the new funds on your member website at btppensions.co.uk/investment-choices.

With Lifestyle strategies, your investment switches are managed for you, rather than you taking a hands-on approach and managing them yourself. Your holdings are moved automatically into the most appropriate funds based on the time left until you want to take your benefits. You can choose your Target Retirement Age by logging into, or registering for, your online account.

Yes, you can invest in as many of the Lifestyle strategies as you wish. You are also able to invest in any of the funds too. However, you should think carefully about your retirement goals and how you plan to use your pension pot. Each of the Lifestyle strategies is different and will move your savings into funds that have an appropriate level of risk as you approach retirement, based on how you plan to use your pot.

Each of the Lifestyle options work in different ways. To learn more, you can read factsheets about each of the three options.

Liverpool Victoria (LV) can offer members access to financial advice to help you make the right choices for your circumstances. You can contact LV on 0800 023 4187. This service is authorised and regulated by the Financial Conduct Authority. Alternatively, you can find independent financial advisers in your local area at Unbiased.co.uk.

Also in this section