Your future starts here

Planning for your retirement has never been easier with your myFund account.

Have you been contacted by Validentity/The Tracing Group? Learn more about the work we’re doing to check members are receiving the right benefits.

Use the quick links below to find the information you need. You can log in to your myFund account to ask for an estimate, make a nomination, switch your investment funds, check your details, and more...

Have you seen our new e-bulletins?

If you're registered for a myFund account you'll now get regular pension updates direct to your inbox. Follow this link to find out what to expect from the new e-bulletins and how to get them if you're not already.

Keep up to date with the latest pensions news and developments in the Fund.

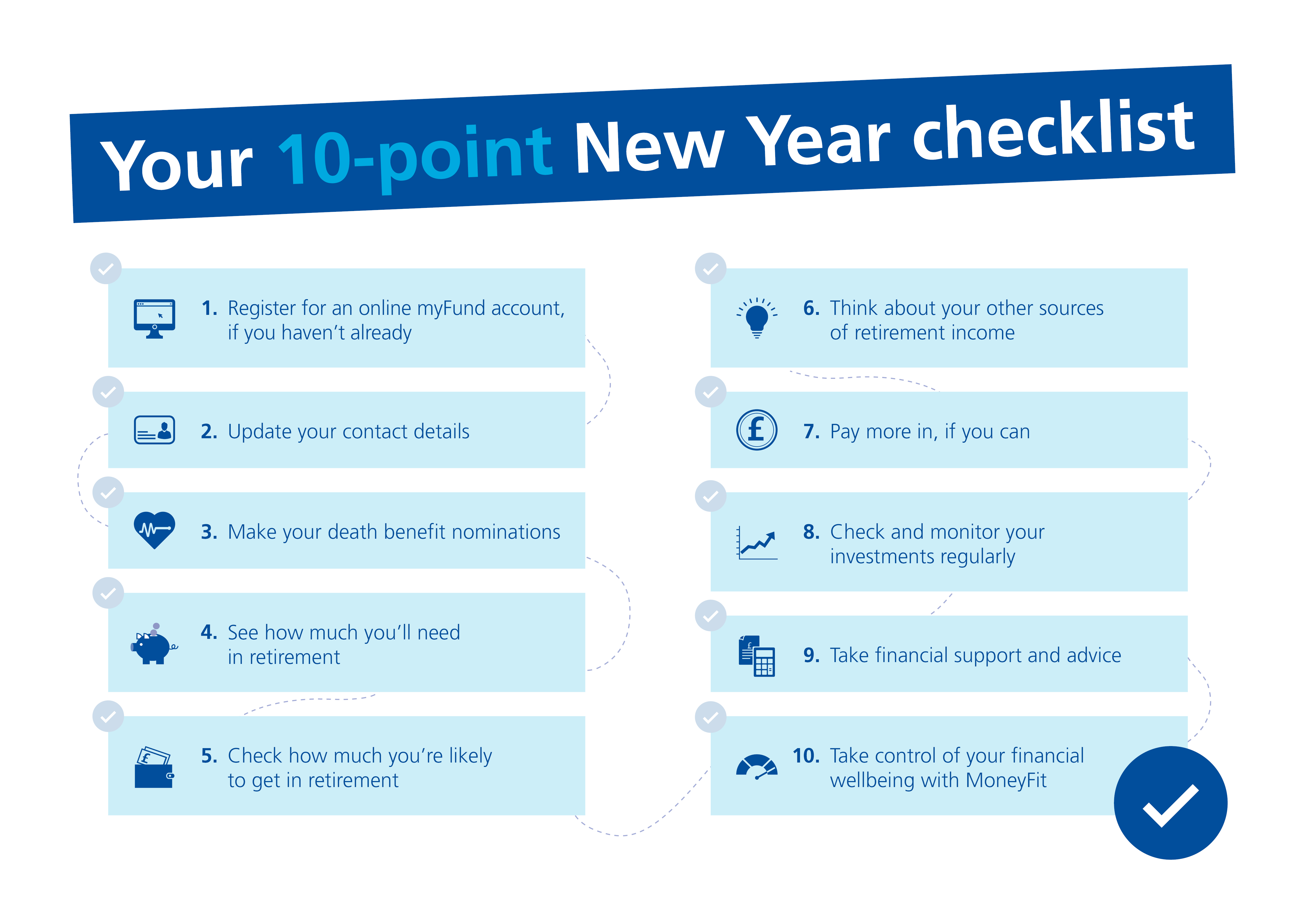

It’s really important that you take control of your retirement planning, no matter what your age. Retirement might feel far away, but with every year that goes by you’re getting closer to it.

Whether you’re just starting to pay into your pension or you're already taking it, we've got information to support you.